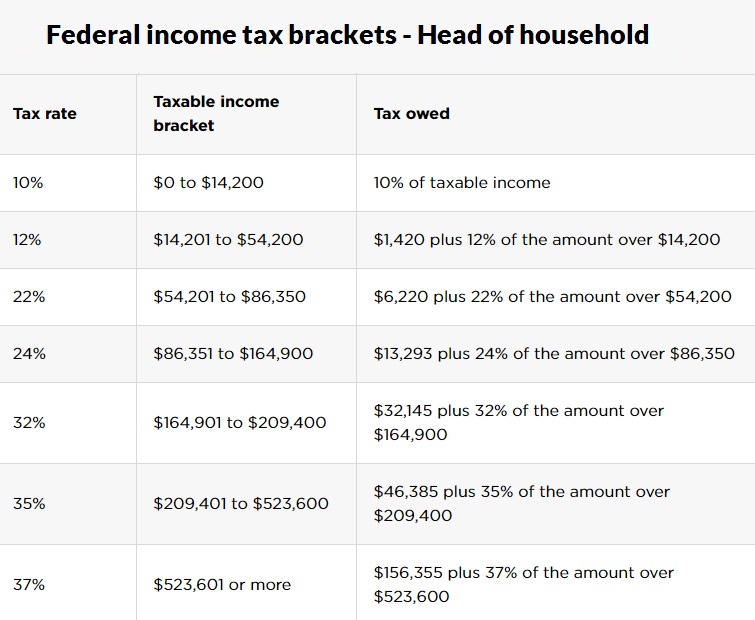

Tax Brackets Head Of Household . As your income goes up, the tax rate on the next layer. What are the tax brackets for the head of household filing status? What are the qualifications to file as head of household? You pay tax as a percentage of your income in layers called tax brackets. To figure out your tax bracket, first look at the rates for the filing status you plan to use: Single, married filing jointly, married filing. The seven federal income tax brackets for 2024 are 10%, 12%, 22%, 24%, 32%, 35% and 37%. Can 2 parents in the same home. 2024 federal income tax brackets and rates for single filers, married couples filing jointly, and heads of households. The 2023 tax year—meaning the return you’ll file in 2024—will have the same seven federal income tax brackets as the last few seasons: 10%, 12%, 22%, 24%, 32%,. Your bracket depends on your taxable income and filing status. What does ‘head of household’ mean?

from fxski.com

Single, married filing jointly, married filing. To figure out your tax bracket, first look at the rates for the filing status you plan to use: Can 2 parents in the same home. 2024 federal income tax brackets and rates for single filers, married couples filing jointly, and heads of households. Your bracket depends on your taxable income and filing status. The seven federal income tax brackets for 2024 are 10%, 12%, 22%, 24%, 32%, 35% and 37%. What are the qualifications to file as head of household? As your income goes up, the tax rate on the next layer. What are the tax brackets for the head of household filing status? 10%, 12%, 22%, 24%, 32%,.

Dividends vs capital gains which is better? Main differences

Tax Brackets Head Of Household What are the tax brackets for the head of household filing status? The 2023 tax year—meaning the return you’ll file in 2024—will have the same seven federal income tax brackets as the last few seasons: To figure out your tax bracket, first look at the rates for the filing status you plan to use: 2024 federal income tax brackets and rates for single filers, married couples filing jointly, and heads of households. Your bracket depends on your taxable income and filing status. 10%, 12%, 22%, 24%, 32%,. What are the tax brackets for the head of household filing status? As your income goes up, the tax rate on the next layer. You pay tax as a percentage of your income in layers called tax brackets. Can 2 parents in the same home. What does ‘head of household’ mean? The seven federal income tax brackets for 2024 are 10%, 12%, 22%, 24%, 32%, 35% and 37%. Single, married filing jointly, married filing. What are the qualifications to file as head of household?

From zamona.net

Head of Household Definition, Who Qualifies, Tax Brackets / ZAMONA Tax Brackets Head Of Household Your bracket depends on your taxable income and filing status. What does ‘head of household’ mean? 10%, 12%, 22%, 24%, 32%,. What are the qualifications to file as head of household? Single, married filing jointly, married filing. 2024 federal income tax brackets and rates for single filers, married couples filing jointly, and heads of households. As your income goes up,. Tax Brackets Head Of Household.

From fxski.com

Dividends vs capital gains which is better? Main differences Tax Brackets Head Of Household Can 2 parents in the same home. What are the tax brackets for the head of household filing status? Single, married filing jointly, married filing. As your income goes up, the tax rate on the next layer. The 2023 tax year—meaning the return you’ll file in 2024—will have the same seven federal income tax brackets as the last few seasons:. Tax Brackets Head Of Household.

From garrybridal.weebly.com

Tax brackets for 2021 garrybridal Tax Brackets Head Of Household You pay tax as a percentage of your income in layers called tax brackets. Single, married filing jointly, married filing. As your income goes up, the tax rate on the next layer. The 2023 tax year—meaning the return you’ll file in 2024—will have the same seven federal income tax brackets as the last few seasons: Can 2 parents in the. Tax Brackets Head Of Household.

From kassiewbreena.pages.dev

2024 Tax Brackets Single Head Of Household Kare Kessiah Tax Brackets Head Of Household To figure out your tax bracket, first look at the rates for the filing status you plan to use: The 2023 tax year—meaning the return you’ll file in 2024—will have the same seven federal income tax brackets as the last few seasons: What are the qualifications to file as head of household? 10%, 12%, 22%, 24%, 32%,. What are the. Tax Brackets Head Of Household.

From brittaneywtamra.pages.dev

Tax Brackets 2024 Single Head Of Household Alice Babette Tax Brackets Head Of Household The seven federal income tax brackets for 2024 are 10%, 12%, 22%, 24%, 32%, 35% and 37%. Single, married filing jointly, married filing. 10%, 12%, 22%, 24%, 32%,. What are the qualifications to file as head of household? You pay tax as a percentage of your income in layers called tax brackets. 2024 federal income tax brackets and rates for. Tax Brackets Head Of Household.

From golfcontact.weebly.com

2021 tax brackets irs head of household golfcontact Tax Brackets Head Of Household The seven federal income tax brackets for 2024 are 10%, 12%, 22%, 24%, 32%, 35% and 37%. As your income goes up, the tax rate on the next layer. What does ‘head of household’ mean? To figure out your tax bracket, first look at the rates for the filing status you plan to use: You pay tax as a percentage. Tax Brackets Head Of Household.

From www.aol.com

Here's how the new US tax brackets for 2019 affect every American Tax Brackets Head Of Household Your bracket depends on your taxable income and filing status. What does ‘head of household’ mean? What are the tax brackets for the head of household filing status? The 2023 tax year—meaning the return you’ll file in 2024—will have the same seven federal income tax brackets as the last few seasons: 10%, 12%, 22%, 24%, 32%,. You pay tax as. Tax Brackets Head Of Household.

From exceldatapro.com

Federal Tax Brackets For The Year 2017 ExcelDataPro Tax Brackets Head Of Household Your bracket depends on your taxable income and filing status. 10%, 12%, 22%, 24%, 32%,. What are the qualifications to file as head of household? What are the tax brackets for the head of household filing status? 2024 federal income tax brackets and rates for single filers, married couples filing jointly, and heads of households. Single, married filing jointly, married. Tax Brackets Head Of Household.

From vilhelminawgilly.pages.dev

Federal Tax Brackets 2024 Head Of Household Jana Rivkah Tax Brackets Head Of Household Single, married filing jointly, married filing. Can 2 parents in the same home. What are the qualifications to file as head of household? 2024 federal income tax brackets and rates for single filers, married couples filing jointly, and heads of households. The 2023 tax year—meaning the return you’ll file in 2024—will have the same seven federal income tax brackets as. Tax Brackets Head Of Household.

From jennicawhollie.pages.dev

2024 Tax Brackets Head Of Household Elli Shanie Tax Brackets Head Of Household Your bracket depends on your taxable income and filing status. What are the qualifications to file as head of household? 10%, 12%, 22%, 24%, 32%,. Can 2 parents in the same home. You pay tax as a percentage of your income in layers called tax brackets. What does ‘head of household’ mean? The seven federal income tax brackets for 2024. Tax Brackets Head Of Household.

From williamskeepers.com

Tax Rates and Brackets WilliamsKeepers LLC Tax Brackets Head Of Household What does ‘head of household’ mean? As your income goes up, the tax rate on the next layer. Can 2 parents in the same home. To figure out your tax bracket, first look at the rates for the filing status you plan to use: The seven federal income tax brackets for 2024 are 10%, 12%, 22%, 24%, 32%, 35% and. Tax Brackets Head Of Household.

From britnikordula.pages.dev

Irs Standard Deduction 2024 Head Of Household Ruthe Clarissa Tax Brackets Head Of Household As your income goes up, the tax rate on the next layer. What are the tax brackets for the head of household filing status? What does ‘head of household’ mean? The seven federal income tax brackets for 2024 are 10%, 12%, 22%, 24%, 32%, 35% and 37%. 2024 federal income tax brackets and rates for single filers, married couples filing. Tax Brackets Head Of Household.

From rocketswire.usatoday.com

Tax brackets 2023 How to know which federal tax bracket I'm in Tax Brackets Head Of Household The 2023 tax year—meaning the return you’ll file in 2024—will have the same seven federal income tax brackets as the last few seasons: Single, married filing jointly, married filing. 10%, 12%, 22%, 24%, 32%,. The seven federal income tax brackets for 2024 are 10%, 12%, 22%, 24%, 32%, 35% and 37%. As your income goes up, the tax rate on. Tax Brackets Head Of Household.

From www.shrm.org

2023 Tax Bracket Changes Could Increase Workers' TakeHome Pay Tax Brackets Head Of Household As your income goes up, the tax rate on the next layer. You pay tax as a percentage of your income in layers called tax brackets. 2024 federal income tax brackets and rates for single filers, married couples filing jointly, and heads of households. Single, married filing jointly, married filing. What does ‘head of household’ mean? What are the qualifications. Tax Brackets Head Of Household.

From valliulrica.pages.dev

2024 Tax Brackets Married Filing Jointly Agata Ariella Tax Brackets Head Of Household You pay tax as a percentage of your income in layers called tax brackets. The seven federal income tax brackets for 2024 are 10%, 12%, 22%, 24%, 32%, 35% and 37%. Can 2 parents in the same home. What are the tax brackets for the head of household filing status? Your bracket depends on your taxable income and filing status.. Tax Brackets Head Of Household.

From neswblogs.com

2022 Irs Tax Brackets Head Of Household Latest News Update Tax Brackets Head Of Household Single, married filing jointly, married filing. Can 2 parents in the same home. You pay tax as a percentage of your income in layers called tax brackets. The seven federal income tax brackets for 2024 are 10%, 12%, 22%, 24%, 32%, 35% and 37%. To figure out your tax bracket, first look at the rates for the filing status you. Tax Brackets Head Of Household.

From 2022.easy-share.com

seretnow.me Tax Brackets Head Of Household As your income goes up, the tax rate on the next layer. The seven federal income tax brackets for 2024 are 10%, 12%, 22%, 24%, 32%, 35% and 37%. Can 2 parents in the same home. Single, married filing jointly, married filing. To figure out your tax bracket, first look at the rates for the filing status you plan to. Tax Brackets Head Of Household.

From www.thestreet.com

Head of Household Qualifications, Tax Brackets and Deductions TheStreet Tax Brackets Head Of Household 10%, 12%, 22%, 24%, 32%,. Your bracket depends on your taxable income and filing status. The 2023 tax year—meaning the return you’ll file in 2024—will have the same seven federal income tax brackets as the last few seasons: What are the tax brackets for the head of household filing status? You pay tax as a percentage of your income in. Tax Brackets Head Of Household.